Above mural, ‘Our Liberation,’ in Oakland, California, by muralist Rachel Wolfe Goldsmith

A bold vision for Black businesses and National Black Business Month

By Terron Ferguson

Last month was National Black Business Month. If February (Black History Month) is an invitation to take a macro view of our accomplishments and the progress made since our country’s founding, August is an opportunity to zoom in on a specific dimension of our contribution to this nation and scrutinize its status with a critical, yet optimistic eye. Many focused their conversations last month on individual Black businesses, but the intention of John William Templeton and Frederick E. Jordan, Sr., when they created the initiative in 2004, was to highlight our Black business community in order to drive policy focused on the needs of Black-owned businesses.

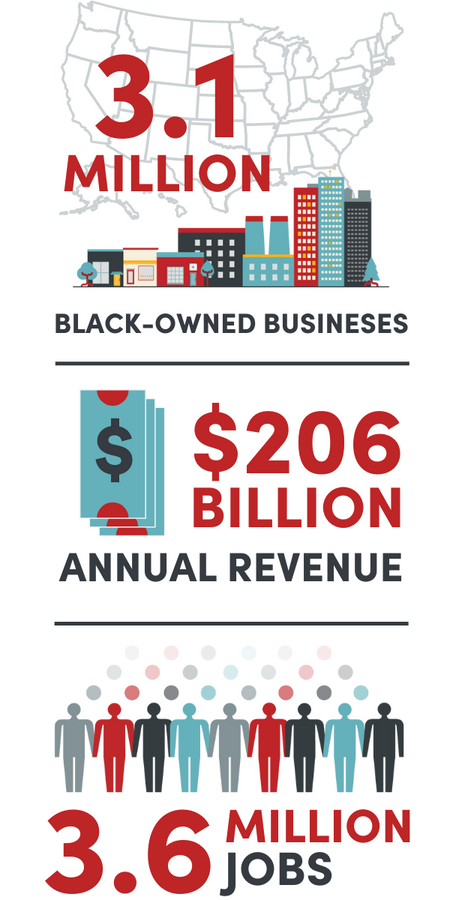

Black businesses are crucial to our nation’s economy. There are 3.1 million Black-owned businesses in the United States, generating $206 billion in annual revenue and supporting 3.6 million jobs. Small business ownership and entrepreneurship are particularly important to communities of color as a source for wealth-building. From a historical perspective, Black enterprise has supplied much-needed capital, in-kind resources, and other forms of support to advance the Black community during some of the most significant socio-political movements in our country. Healthy Black-owned businesses are also vital strategic tools for addressing the racial wealth gap—the gap between the incomes of white and Black households is estimated to cost the economy $1 to $1.5 trillion per year by 2028.

Black businesses are crucial to our nation’s economy. There are 3.1 million Black-owned businesses in the United States, generating $206 billion in annual revenue and supporting 3.6 million jobs. Small business ownership and entrepreneurship are particularly important to communities of color as a source for wealth-building. From a historical perspective, Black enterprise has supplied much-needed capital, in-kind resources, and other forms of support to advance the Black community during some of the most significant socio-political movements in our country. Healthy Black-owned businesses are also vital strategic tools for addressing the racial wealth gap—the gap between the incomes of white and Black households is estimated to cost the economy $1 to $1.5 trillion per year by 2028.

There are a lot of important ways to support the growth of Black-owned businesses. We can continue to push for greater access to capital, expand the aperture of creditworthiness and connect young entrepreneurs with mentors. There are two additional strategies that, if embraced and scaled, will generate many more Black business owners. First, preserve Black-owned businesses through succession planning. 64% of business owners over the age of 50 have no formal business succession plan, putting their largest asset and family’s wealth and security at risk. Second, help legacy businesses (owned by folks who aren’t Black) with significant Black employee bases transition to employee ownership. Over half of business owners in the U.S. are age 55 or older. This means the “Silver Tsunami” of retiring workers is bringing a wave of businesses for sale.

Employee ownership is commonly used to help attract and retain employees and provide long-term wealth building. It also supports an engaged work culture, empowering employees to think and act like owners. Different forms of employee ownership exist, including: employee stock ownership plans (ESOPs), employee ownership trusts (EOTs) and worker cooperatives.

ESOPs are qualified retirement plans used to transfer shares of the company into a trust, administered on behalf of the employees. Employees earn their shares as a retirement benefit. ESOPs come with very significant tax benefits. This coupled with regulation and higher costs, make them more attractive to companies with more than 40 employees.

EOTs, sometimes called Perpetual Employee Trusts, preserve the business for the benefit of the employees. Employees don’t pay for their ownership benefits, and they receive a share of the company’s annual profits. EOTs have lower set up costs.

Worker cooperatives are 100% employee-owned and are governed by the people who work there. Employees pay a small equity buy-in and the board of directors is mostly made up of employee-owners elected by the full membership. Profit-sharing is built into the model and is based on hours worked. Worker cooperatives have lower setup costs.

Regardless of type, employee ownership is good for business owners, workers and communities. If the Black business community were to embrace it, employee ownership could become a dynamic strategy to build economic resilience and community wealth and chip away at the racial wealth gap. This kind of cooperative economics is not a new idea for our community, just an underutilized one. National Black Business Month is a radical opportunity for us to re-envision the archetype of Black business ownership. In turn, our imagination might yield a new portrait of our Black business community.

There are 41.1 million Black Americans living in the U.S. Black workers account for 15 million, or 12 percent, of the 125 million U.S. private-sector workers. Nearly 60% of our Black workforce lives in Southern states. 50% of Black workers are concentrated in three U.S. industries: healthcare, retail and accommodation and food service. The 20,000 Silver Tsunami businesses in Miami, Florida account for $70 billion in revenues. Imagine transitioning them into employee-owned companies. This would result in over 242,000 workers becoming owners. Imagine transitioning the 30,000 Silver Tsunami businesses in Atlanta, Georgia, which account for $163 billion in revenues, into employee-owned companies. This would result in over 430,000 workers becoming owners. The potential spillover effects to the Black community are enormous.

What if we took lessons from Tulsa’s Black Wall Street, Atlanta’s Auburn Avenue, and Maryland’s Prince George’s county? Starting with our historic Black business districts, we have the chance to re-hardwire our business community with cooperative economics and employee ownership. Central to one of Project Equity’s initial hypotheses is the idea that a place-based approach increases the likelihood of employee ownership taking root in a local ecosystem. In 2021, understanding the incredible impact potential of focusing on the Black workforce, Project Equity launched its Black Employee Ownership Initiative (BEOI). The BEOI engages stakeholders in key U.S. regions to raise awareness about employee ownership, connect with business owners who might be interested in employee ownership and elevate employee ownership to local and national agendas.

We ought to utilize every August to talk seriously about cooperative economics and employee ownership in the Black community. Doing so will enable us to update a bold vision for our commercial future, issuing a call of action to all stakeholders involved: financial institutions, business owners, business associations and connectors, academics, policy and political leaders. Let’s all answer the charge set forth by Mr. Templeton and Mr. Jordan, Sr. and undertake this sensitive, seismic change management project for our country.

Today, you can ask a small business owner whether or not they’re familiar with employee ownership. All of us know, or are proximate to, a small business owner. 99% of our country’s businesses are small businesses. Almost half of all U.S. workers are employed by them. The more Black business owners, business owners with large workforces of color and owners who are looking to exit their businesses know about employee ownership, the greater the groundswell of transitions to employee ownership. If Project Equity can commit to our BEOI work for the long haul, and you can agree to lead these conversations in your community, our leaders will follow suit.

Together, let’s commit to taking stock of our progress, every August, during National Black Business Month.

About the author

Terron is an initiative builder and advocate from Miami, Florida. He has practiced law at the Equal Justice Initiative in Montgomery, Alabama, advocating against death sentences, children detained in adult prisons and facilitating parole hearings. At Project Equity, Terron advances the Black Employee Ownership Initiative, which centers Black employee ownership in all of our strategic initiatives.

Black businesses are crucial to our nation’s economy. There are 3.1 million Black-owned businesses in the United States, generating $206 billion in annual revenue and supporting 3.6 million jobs. Small business ownership and entrepreneurship are particularly important to communities of color as a source for wealth-building. From a historical perspective, Black enterprise has supplied much-needed capital, in-kind resources, and other forms of support to advance the Black community during some of the most significant socio-political movements in our country. Healthy Black-owned businesses are also vital strategic tools for addressing the racial wealth gap—the gap between the incomes of white and Black households is estimated to cost the economy $1 to $1.5 trillion per year by 2028.

There are a lot of important ways to support the growth of Black-owned businesses. We can continue to push for greater access to capital, expand the aperture of creditworthiness and connect young entrepreneurs with mentors. There are two additional strategies that, if embraced and scaled, will generate many more Black business owners.

First, preserve Black-owned businesses through succession planning. 64% of business owners over the age of 50 have no formal business succession plan, putting their largest asset and family’s wealth and security at risk. Second, help legacy businesses (owned by folks who aren’t Black) with significant Black employee bases transition to employee ownership. Over half of business owners in the U.S. are age 55 or older. This means the “Silver Tsunami” of retiring workers is bringing a wave of businesses for sale.

Employee ownership is commonly used to help attract and retain employees and provide long-term wealth building. It also supports an engaged work culture, empowering employees to think and act like owners. Different forms of employee ownership exist, including: employee stock ownership plans (ESOPs), employee ownership trusts (EOTs) and worker cooperatives.

ESOPs are qualified retirement plans used to transfer shares of the company into a trust, administered on behalf of the employees. Employees earn their shares as a retirement benefit. ESOPs come with very significant tax benefits. This coupled with regulation and higher costs, make them more attractive to companies with more than 40 employees.

EOTs, sometimes called Perpetual Employee Trusts, preserve the business for the benefit of the employees. Employees don’t pay for their ownership benefits, and they receive a share of the company’s annual profits. EOTs have lower set up costs.

Worker cooperatives are 100% employee-owned and are governed by the people who work there. Employees pay a small equity buy-in and the board of directors is mostly made up of employee-owners elected by the full membership. Profit-sharing is built into the model and is based on hours worked. Worker cooperatives have lower setup costs.

Regardless of type, employee ownership is good for business owners, workers and communities. If the Black business community were to embrace it, employee ownership could become a dynamic strategy to build economic resilience and community wealth and chip away at the racial wealth gap. This kind of cooperative economics is not a new idea for our community, just an underutilized one. National Black Business Month is a radical opportunity for us to re-envision the archetype of Black business ownership. In turn, our imagination might yield a new portrait of our Black business community.

There are 41.1 million Black Americans living in the U.S. Black workers account for 15 million, or 12 percent, of the 125 million U.S. private-sector workers. Nearly 60% of our Black workforce lives in Southern states. 50% of Black workers are concentrated in three U.S. industries: healthcare, retail and accommodation and food service. The 20,000 Silver Tsunami businesses in Miami, Florida account for $70 billion in revenues. Imagine transitioning them into employee-owned companies. This would result in over 242,000 workers becoming owners. Imagine transitioning the 30,000 Silver Tsunami businesses in Atlanta, Georgia, which account for $163 billion in revenues, into employee-owned companies. This would result in over 430,000 workers becoming owners. The potential spillover effects to the Black community are enormous.

There are 41.1 million Black Americans living in the U.S. Black workers account for 15 million, or 12 percent, of the 125 million U.S. private-sector workers. Nearly 60% of our Black workforce lives in Southern states. 50% of Black workers are concentrated in three U.S. industries: healthcare, retail and accommodation and food service. The 20,000 Silver Tsunami businesses in Miami, Florida account for $70 billion in revenues. Imagine transitioning them into employee-owned companies. This would result in over 242,000 workers becoming owners. Imagine transitioning the 30,000 Silver Tsunami businesses in Atlanta, Georgia, which account for $163 billion in revenues, into employee-owned companies. This would result in over 430,000 workers becoming owners. The potential spillover effects to the Black community are enormous.

What if we took lessons from Tulsa’s Black Wall Street, Atlanta’s Auburn Avenue, and Maryland’s Prince George’s county? Starting with our historic Black business districts, we have the chance to re-hardwire our business community with cooperative economics and employee ownership. Central to one of Project Equity’s initial hypotheses is the idea that a place-based approach increases the likelihood of employee ownership taking root in a local ecosystem. In 2021, understanding the incredible impact potential of focusing on the Black workforce, Project Equity launched its Black Employee Ownership Initiative (BEOI). The BEOI engages stakeholders in key U.S. regions to raise awareness about employee ownership, connect with business owners who might be interested in employee ownership and elevate employee ownership to local and national agendas.

We ought to utilize every August to talk seriously about cooperative economics and employee ownership in the Black community. Doing so will enable us to update a bold vision for our commercial future, issuing a call of action to all stakeholders involved: financial institutions, business owners, business associations and connectors, academics, policy and political leaders. Let’s all answer the charge set forth by Mr. Templeton and Mr. Jordan, Sr. and undertake this sensitive, seismic change management project for our country.

Today, you can ask a small business owner whether or not they’re familiar with employee ownership. All of us know, or are proximate to, a small business owner. 99% of our country’s businesses are small businesses. Almost half of all U.S. workers are employed by them. The more Black business owners, business owners with large workforces of color and owners who are looking to exit their businesses know about employee ownership, the greater the groundswell of transitions to employee ownership. If Project Equity can commit to our BEOI work for the long haul, and you can agree to lead these conversations in your community, our leaders will follow suit.

Together, let’s commit to taking stock of our progress, every August, during National Black Business Month.